Students / Educators / Employers & Professionals

Please sign up below for more information about

our programs for verified trading credentials

ALPHASEAL® is a platform for recording trade ideas. Students can trade fantasy portfolios on our website or send us a trade blotter from another simulator. ALPHASEAL® provides statistical feedback similar to what professional traders and analysts would see so that students can be more competitive in the job market.

How do I win?

There are two components to the 2014-2015 All-America Student Analyst Competition

1.) The General competition

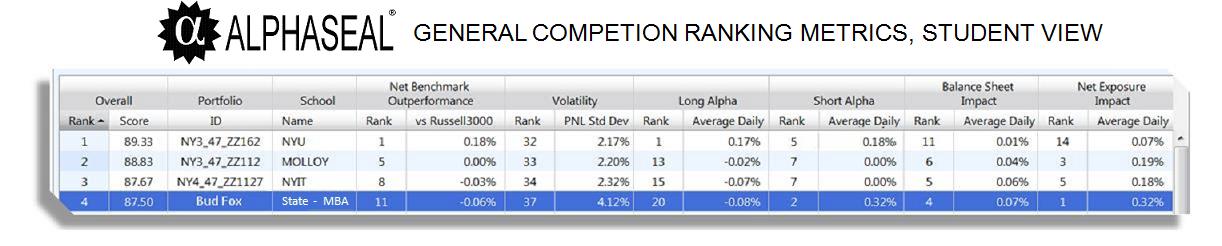

Each student will have the opportunity to manage a portfolio of US equities; equities traded on major US exchanges and tradeable fund products like ETFs and mutual funds. Your professor will decide if you trade on our simulator or on one of several simulators that we support. ALPHASEAL measures daily performance of your portfolio on six factors: Performance vs. Russell3000; Volatility; Long Alpha; Short Alpha; Balance Sheet Impact; Net Exposure Impact. For definitions of these factors, refer to our Learning Center.

Each portfolio is ranked in each category. In the Volatility category, lower is better. In the Short Alpha category, students who have no short exposure during the competition tie for last. All other competitors are ranked from highest to lowest. In the four other categories, competitors are ranked from highest to lowest.

The goal of the General competition is to achieve the highest rank in each of the six categorites. For the math, click here.

2.) The Sectors competition

We have compiled a list of equities that trade on US exchanges which correspond to one of the seven sectors in the professional Institutional Investor analyst rankings. Those sectors are:

Basic Materials

Capital Goods

Consumer

Energy

Financials

Healthcare

Technology, Media and Telecommunications

ALPHASEAL will look at the list of holdings in the General portfolios of every competitor every night. If one of the positions in the General portfolio is on our Sectors list, we will automatically create a matching entry in the particular student’s Sectors portfolio. Students may not over-ride this. (for an explanation of why not, see Learning Center, “Henry Blodget Settlement, 2003”).

Students may add names to their Sectors portfolio that are not in their General portfolios. If a student exits a position in their General portfolio, it will remain in their Sectors portfolio with a “Neutral” rating.

The Sectors competition will only begin on November 2, 2014. Nothing that happens before October 1 will impact rankings in the Sectors rankings. This will give students an opportunity to get familiar with the process. More information about the Sectors competition will be published before November 2, 2014.

ALPHASEAL® creates an auditable and third-party verifiable track record of fantasy portfolios and trading ideas so that students who perform well in competition will qualify for an internship draft to be held each winter. Recruiters will have the opportunity to review performance statistics of students they are interested to hire for summer internship positions. In addition, Institutional Investor Magazine will publish a list of top performers in either their May 2014 monthly issue. In addition to recruiting opportunities, last year’s top performers received media attention from CNBC, Businessweek, Yahoo! Finance and other media outlets.

How can I sign up?At this moment, students must be invited to ALPHASEAL® by a professor or investment club advisor who has enrolled your school with us. If you have already received credentials, you may log in here.

FAQ

What is the cost?

There is no cost to schools, professors, or advisers of investment clubs. Once enrolled, you may invite as many of your students as you like at no cost to them. The rankings are sponsored through a relationship with Institutional Investor magazine. We will make a free trading simulator available for schools and investment clubs that request it.

Is this event for undergraduate students, graduate students or both?

The Fall 2014 event is open to undergraduate and graduate students at accredited universities in the United States. It is expected that professors and investment club advisors who enroll students are confirming the student’s status as currently matriculating in a program with which they are affiliated. Schools that are not currently accredited may be accepted at our discretion.

What are the relevant dates?

Begin

End

Description

05/01/2014 08/29/2014 Fall 2014 pre-registration period 08/25/2014 10/31/2014 Professors/Advisors loaded into ALPHASEAL 08/25/2014 10/31/2014 Students uploaded 08/25/2014 11/02/2014 First student trade 08/25/2014 01/30/2014 Competition period 02/01/2014 04/30/2014 Results audited & reported

Institutional Investor magazine will publish a list of top performers in either their May 2015 monthly issue.

What about privacy?

All of our systems are secured and data is stored in a co-location facility with multiple redundancies. Students’ accounts may be reviewed by the professor or advisor who enrolled them for the duration of the competition. After the Fall 2014 event finishes, students will retain the right to decide who can access their trade data. Students who qualify for the internship draft will have to “opt-in” to allow recruiters to access their competition data. Recruiters and employers will only have access to the students’ data that emanated from the Fall 2014 event. Other than top performers names, who are published in Institutional Investor's online and print editions, we do not sell or share names contact information or details of the portfolios for any of our users for any reason. We may analyze demographics of our users and report it in an aggregate fashion, for instance: percent of top performers that are women vs. percent women in the total event population.

What statistics does ALPHASEAL® track?

ALPHASEAL tracks the equity value of portfolios, the NAV, and the daily profit and loss (PNL) from all open positions minus transaction costs. PNL includes proceeds of dividends. Transaction costs include brokerage fees and the net impact of interest which we normalize across all competitors. We use that data to calculate PNL by position for alpha generation on a daily basis from both long positions and short positions. We calculate impact of leverage by dividing daily PNL by gross exposure and subtracting un-levered PNL. We calculate impact of net exposure by subtracting the portfolio PNL from the calculation of the Russell3000 return multiplied by the portfolio net exposure. All daily values are totaled across the competition period and divided by the number of trading days the students participated. Standard deviation of daily PNL is measured from the beginning of the students trading period through the most recent trading day. The minimum trading period is from November 1, 2013 – January 31, 2014 which is approximately 90 days. Although the following statistics do not influence the rankings, we provide them on a daily and average basis for formative purposes: long exposure; short exposure; long return; short return. We will provide all mathematical formulas in advance of the official competition start.

What differentiates ALPHASEAL?

We include a qualitative “Trade Journal” in the section of the website where the trade blotter is presented. Students will be encouraged to record the “thinking” behind their trading decisions. We will time-stamp their entries. Professors will be able to see their students’ trade journals and respond with time-stamped messages in-line. Employers have expressed particular interest in analyzing the “intellectual honesty” and “humility” of potential recruits by reviewing their qualitative entries and assessing the student trader’s management of a particular investment thesis over time.

There is no cost to schools, professors, or advisers of investment clubs. Once enrolled, you may invite as many of your students as you like at no cost to them. The rankings are sponsored through a relationship with Institutional Investor magazine. We will make a free trading simulator available for schools and investment clubs that request it.

Is this event for undergraduate students, graduate students or both?

The Fall 2014 event is open to undergraduate and graduate students at accredited universities in the United States. It is expected that professors and investment club advisors who enroll students are confirming the student’s status as currently matriculating in a program with which they are affiliated. Schools that are not currently accredited may be accepted at our discretion.

What are the relevant dates?

Begin

End

Description

05/01/2014 08/29/2014 Fall 2014 pre-registration period 08/25/2014 10/31/2014 Professors/Advisors loaded into ALPHASEAL 08/25/2014 10/31/2014 Students uploaded 08/25/2014 11/02/2014 First student trade 08/25/2014 01/30/2014 Competition period 02/01/2014 04/30/2014 Results audited & reported

Institutional Investor magazine will publish a list of top performers in either their May 2015 monthly issue.

What about privacy?

All of our systems are secured and data is stored in a co-location facility with multiple redundancies. Students’ accounts may be reviewed by the professor or advisor who enrolled them for the duration of the competition. After the Fall 2014 event finishes, students will retain the right to decide who can access their trade data. Students who qualify for the internship draft will have to “opt-in” to allow recruiters to access their competition data. Recruiters and employers will only have access to the students’ data that emanated from the Fall 2014 event. Other than top performers names, who are published in Institutional Investor's online and print editions, we do not sell or share names contact information or details of the portfolios for any of our users for any reason. We may analyze demographics of our users and report it in an aggregate fashion, for instance: percent of top performers that are women vs. percent women in the total event population.

What statistics does ALPHASEAL® track?

ALPHASEAL tracks the equity value of portfolios, the NAV, and the daily profit and loss (PNL) from all open positions minus transaction costs. PNL includes proceeds of dividends. Transaction costs include brokerage fees and the net impact of interest which we normalize across all competitors. We use that data to calculate PNL by position for alpha generation on a daily basis from both long positions and short positions. We calculate impact of leverage by dividing daily PNL by gross exposure and subtracting un-levered PNL. We calculate impact of net exposure by subtracting the portfolio PNL from the calculation of the Russell3000 return multiplied by the portfolio net exposure. All daily values are totaled across the competition period and divided by the number of trading days the students participated. Standard deviation of daily PNL is measured from the beginning of the students trading period through the most recent trading day. The minimum trading period is from November 1, 2013 – January 31, 2014 which is approximately 90 days. Although the following statistics do not influence the rankings, we provide them on a daily and average basis for formative purposes: long exposure; short exposure; long return; short return. We will provide all mathematical formulas in advance of the official competition start.

What differentiates ALPHASEAL?

We include a qualitative “Trade Journal” in the section of the website where the trade blotter is presented. Students will be encouraged to record the “thinking” behind their trading decisions. We will time-stamp their entries. Professors will be able to see their students’ trade journals and respond with time-stamped messages in-line. Employers have expressed particular interest in analyzing the “intellectual honesty” and “humility” of potential recruits by reviewing their qualitative entries and assessing the student trader’s management of a particular investment thesis over time.

The Fall 2014 event is open to undergraduate and graduate students at accredited universities in the United States. It is expected that professors and investment club advisors who enroll students are confirming the student’s status as currently matriculating in a program with which they are affiliated. Schools that are not currently accredited may be accepted at our discretion.

What are the relevant dates?

Begin

End

Description

05/01/2014 08/29/2014 Fall 2014 pre-registration period 08/25/2014 10/31/2014 Professors/Advisors loaded into ALPHASEAL 08/25/2014 10/31/2014 Students uploaded 08/25/2014 11/02/2014 First student trade 08/25/2014 01/30/2014 Competition period 02/01/2014 04/30/2014 Results audited & reported

Institutional Investor magazine will publish a list of top performers in either their May 2015 monthly issue.

What about privacy?

All of our systems are secured and data is stored in a co-location facility with multiple redundancies. Students’ accounts may be reviewed by the professor or advisor who enrolled them for the duration of the competition. After the Fall 2014 event finishes, students will retain the right to decide who can access their trade data. Students who qualify for the internship draft will have to “opt-in” to allow recruiters to access their competition data. Recruiters and employers will only have access to the students’ data that emanated from the Fall 2014 event. Other than top performers names, who are published in Institutional Investor's online and print editions, we do not sell or share names contact information or details of the portfolios for any of our users for any reason. We may analyze demographics of our users and report it in an aggregate fashion, for instance: percent of top performers that are women vs. percent women in the total event population.

What statistics does ALPHASEAL® track?

ALPHASEAL tracks the equity value of portfolios, the NAV, and the daily profit and loss (PNL) from all open positions minus transaction costs. PNL includes proceeds of dividends. Transaction costs include brokerage fees and the net impact of interest which we normalize across all competitors. We use that data to calculate PNL by position for alpha generation on a daily basis from both long positions and short positions. We calculate impact of leverage by dividing daily PNL by gross exposure and subtracting un-levered PNL. We calculate impact of net exposure by subtracting the portfolio PNL from the calculation of the Russell3000 return multiplied by the portfolio net exposure. All daily values are totaled across the competition period and divided by the number of trading days the students participated. Standard deviation of daily PNL is measured from the beginning of the students trading period through the most recent trading day. The minimum trading period is from November 1, 2013 – January 31, 2014 which is approximately 90 days. Although the following statistics do not influence the rankings, we provide them on a daily and average basis for formative purposes: long exposure; short exposure; long return; short return. We will provide all mathematical formulas in advance of the official competition start.

What differentiates ALPHASEAL?

We include a qualitative “Trade Journal” in the section of the website where the trade blotter is presented. Students will be encouraged to record the “thinking” behind their trading decisions. We will time-stamp their entries. Professors will be able to see their students’ trade journals and respond with time-stamped messages in-line. Employers have expressed particular interest in analyzing the “intellectual honesty” and “humility” of potential recruits by reviewing their qualitative entries and assessing the student trader’s management of a particular investment thesis over time.

| Begin | End | Description |

| 05/01/2014 | 08/29/2014 | Fall 2014 pre-registration period |

| 08/25/2014 | 10/31/2014 | Professors/Advisors loaded into ALPHASEAL |

| 08/25/2014 | 10/31/2014 | Students uploaded |

| 08/25/2014 | 11/02/2014 | First student trade |

| 08/25/2014 | 01/30/2014 | Competition period |

| 02/01/2014 | 04/30/2014 | Results audited & reported |

Institutional Investor magazine will publish a list of top performers in either their May 2015 monthly issue.

What about privacy?

All of our systems are secured and data is stored in a co-location facility with multiple redundancies. Students’ accounts may be reviewed by the professor or advisor who enrolled them for the duration of the competition. After the Fall 2014 event finishes, students will retain the right to decide who can access their trade data. Students who qualify for the internship draft will have to “opt-in” to allow recruiters to access their competition data. Recruiters and employers will only have access to the students’ data that emanated from the Fall 2014 event. Other than top performers names, who are published in Institutional Investor's online and print editions, we do not sell or share names contact information or details of the portfolios for any of our users for any reason. We may analyze demographics of our users and report it in an aggregate fashion, for instance: percent of top performers that are women vs. percent women in the total event population.

What statistics does ALPHASEAL® track?

ALPHASEAL tracks the equity value of portfolios, the NAV, and the daily profit and loss (PNL) from all open positions minus transaction costs. PNL includes proceeds of dividends. Transaction costs include brokerage fees and the net impact of interest which we normalize across all competitors. We use that data to calculate PNL by position for alpha generation on a daily basis from both long positions and short positions. We calculate impact of leverage by dividing daily PNL by gross exposure and subtracting un-levered PNL. We calculate impact of net exposure by subtracting the portfolio PNL from the calculation of the Russell3000 return multiplied by the portfolio net exposure. All daily values are totaled across the competition period and divided by the number of trading days the students participated. Standard deviation of daily PNL is measured from the beginning of the students trading period through the most recent trading day. The minimum trading period is from November 1, 2013 – January 31, 2014 which is approximately 90 days. Although the following statistics do not influence the rankings, we provide them on a daily and average basis for formative purposes: long exposure; short exposure; long return; short return. We will provide all mathematical formulas in advance of the official competition start.

What differentiates ALPHASEAL?

We include a qualitative “Trade Journal” in the section of the website where the trade blotter is presented. Students will be encouraged to record the “thinking” behind their trading decisions. We will time-stamp their entries. Professors will be able to see their students’ trade journals and respond with time-stamped messages in-line. Employers have expressed particular interest in analyzing the “intellectual honesty” and “humility” of potential recruits by reviewing their qualitative entries and assessing the student trader’s management of a particular investment thesis over time.

All of our systems are secured and data is stored in a co-location facility with multiple redundancies. Students’ accounts may be reviewed by the professor or advisor who enrolled them for the duration of the competition. After the Fall 2014 event finishes, students will retain the right to decide who can access their trade data. Students who qualify for the internship draft will have to “opt-in” to allow recruiters to access their competition data. Recruiters and employers will only have access to the students’ data that emanated from the Fall 2014 event. Other than top performers names, who are published in Institutional Investor's online and print editions, we do not sell or share names contact information or details of the portfolios for any of our users for any reason. We may analyze demographics of our users and report it in an aggregate fashion, for instance: percent of top performers that are women vs. percent women in the total event population.

What statistics does ALPHASEAL® track?

ALPHASEAL tracks the equity value of portfolios, the NAV, and the daily profit and loss (PNL) from all open positions minus transaction costs. PNL includes proceeds of dividends. Transaction costs include brokerage fees and the net impact of interest which we normalize across all competitors. We use that data to calculate PNL by position for alpha generation on a daily basis from both long positions and short positions. We calculate impact of leverage by dividing daily PNL by gross exposure and subtracting un-levered PNL. We calculate impact of net exposure by subtracting the portfolio PNL from the calculation of the Russell3000 return multiplied by the portfolio net exposure. All daily values are totaled across the competition period and divided by the number of trading days the students participated. Standard deviation of daily PNL is measured from the beginning of the students trading period through the most recent trading day. The minimum trading period is from November 1, 2013 – January 31, 2014 which is approximately 90 days. Although the following statistics do not influence the rankings, we provide them on a daily and average basis for formative purposes: long exposure; short exposure; long return; short return. We will provide all mathematical formulas in advance of the official competition start.

What differentiates ALPHASEAL?

We include a qualitative “Trade Journal” in the section of the website where the trade blotter is presented. Students will be encouraged to record the “thinking” behind their trading decisions. We will time-stamp their entries. Professors will be able to see their students’ trade journals and respond with time-stamped messages in-line. Employers have expressed particular interest in analyzing the “intellectual honesty” and “humility” of potential recruits by reviewing their qualitative entries and assessing the student trader’s management of a particular investment thesis over time.

ALPHASEAL tracks the equity value of portfolios, the NAV, and the daily profit and loss (PNL) from all open positions minus transaction costs. PNL includes proceeds of dividends. Transaction costs include brokerage fees and the net impact of interest which we normalize across all competitors. We use that data to calculate PNL by position for alpha generation on a daily basis from both long positions and short positions. We calculate impact of leverage by dividing daily PNL by gross exposure and subtracting un-levered PNL. We calculate impact of net exposure by subtracting the portfolio PNL from the calculation of the Russell3000 return multiplied by the portfolio net exposure. All daily values are totaled across the competition period and divided by the number of trading days the students participated. Standard deviation of daily PNL is measured from the beginning of the students trading period through the most recent trading day. The minimum trading period is from November 1, 2013 – January 31, 2014 which is approximately 90 days. Although the following statistics do not influence the rankings, we provide them on a daily and average basis for formative purposes: long exposure; short exposure; long return; short return. We will provide all mathematical formulas in advance of the official competition start.

What differentiates ALPHASEAL?

We include a qualitative “Trade Journal” in the section of the website where the trade blotter is presented. Students will be encouraged to record the “thinking” behind their trading decisions. We will time-stamp their entries. Professors will be able to see their students’ trade journals and respond with time-stamped messages in-line. Employers have expressed particular interest in analyzing the “intellectual honesty” and “humility” of potential recruits by reviewing their qualitative entries and assessing the student trader’s management of a particular investment thesis over time.

We include a qualitative “Trade Journal” in the section of the website where the trade blotter is presented. Students will be encouraged to record the “thinking” behind their trading decisions. We will time-stamp their entries. Professors will be able to see their students’ trade journals and respond with time-stamped messages in-line. Employers have expressed particular interest in analyzing the “intellectual honesty” and “humility” of potential recruits by reviewing their qualitative entries and assessing the student trader’s management of a particular investment thesis over time.